mratsim / Home Credit Default Risk

Programming Languages

Projects that are alternatives of or similar to Home Credit Default Risk

Home Credit default risk

This is code I built for the Home Credit default risk competition on Kaggle. This should be seen more as an ML engineering achievement than a data science top of the line prediction model.

What will you find in the repo?

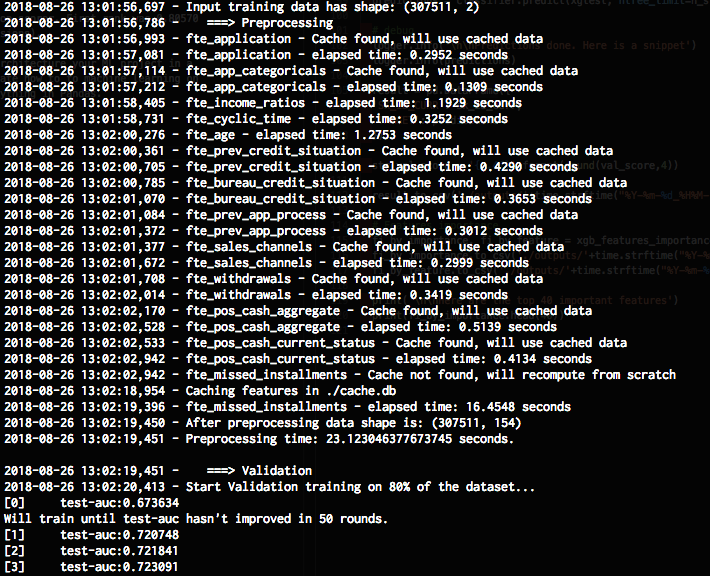

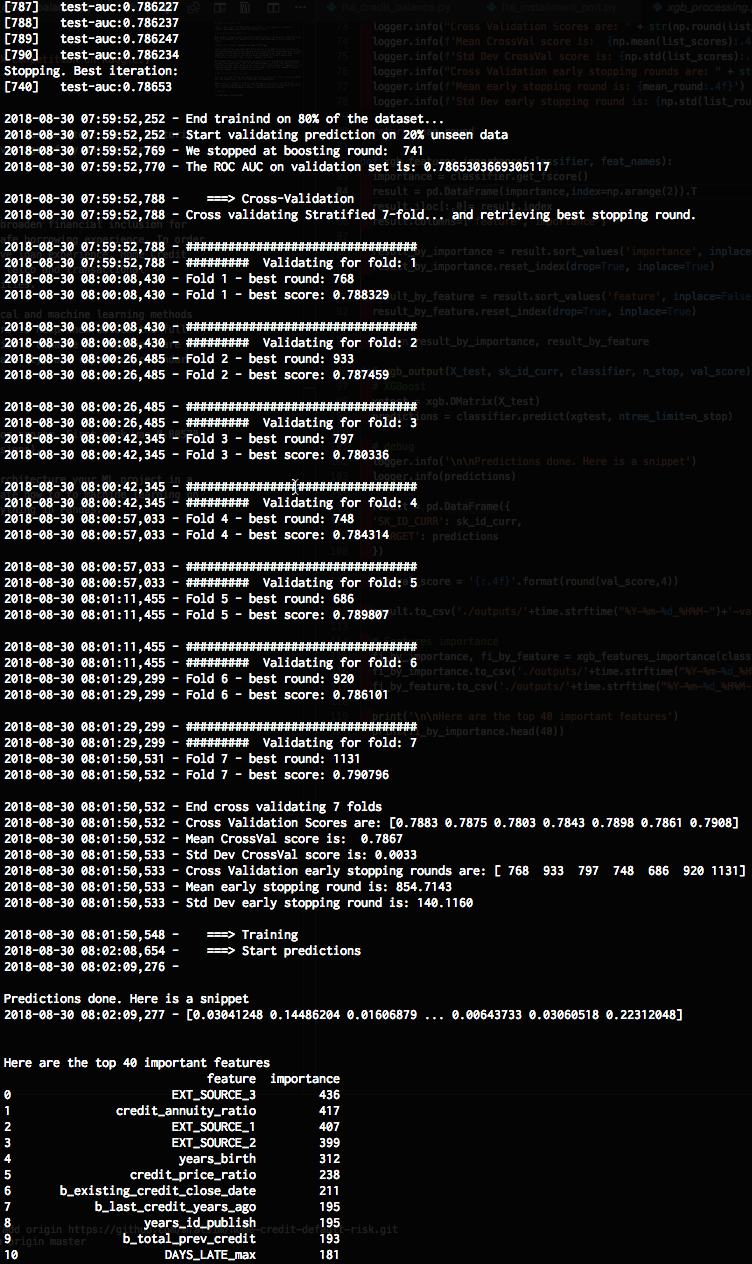

First of all, due to time constraints this is not a top scorer. First rank was 0.80570 AUC (499 submissions), this is 0.78212 AUC (12 submissions).

However you will hopefully find an inspiring way to architecture your ML project in a fast, scalable and maintainable way. It also demonstrate how to to machine learning on top of existing SQL databases instead of loading everything in Pandas.

Teasers

Table of Contents

If you're a Kaggler and just want to run the code go to Starting point. Otherwise, skip the starting point and go directly to the competition description.

- Home Credit default risk

- What will you find in the repo?

- Teasers

- Table of Contents

- Starting point

- Description of the competition

- Fast to run and iterate

- Maintainable

- Scalable

- Conclusion

Starting point

The code expects all CSVs to be stored in a SQlite database in ./inputs/inputs.db.

Data is available on Kaggle Home Credit default risk competition:

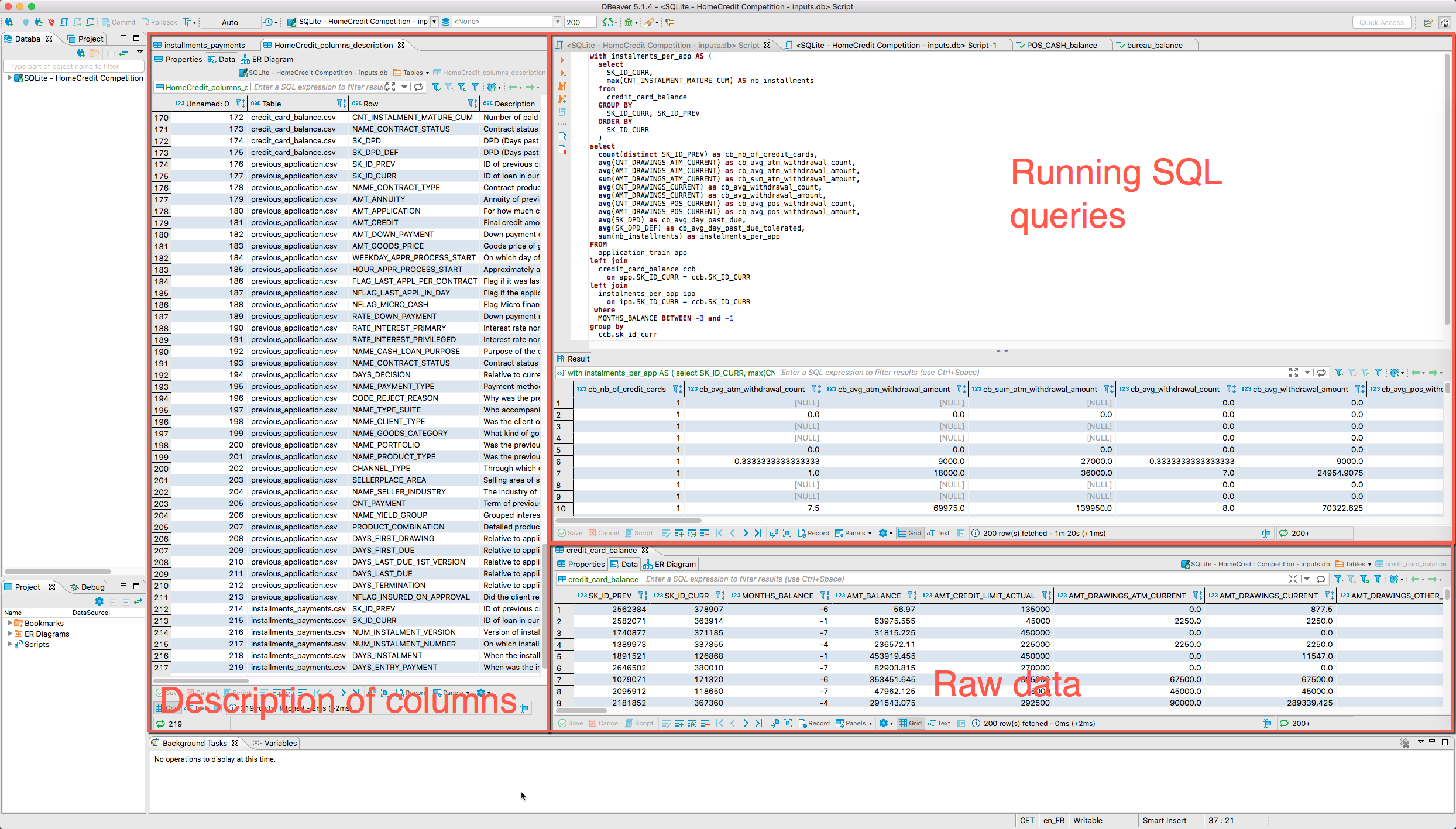

I used csvs-to-sqlite https://github.com/simonw/csvs-to-sqlite, which is built on top of Pandas. Note that the new DBeaver 5.1.5 added CSV import, it's my recommended SQL browser in any case.

Expected table names are:

- application_train

- application_test

- previous_application

- bureau

- bureau_balance

- credit_card_balance

- installments_payments

- POS_CASH_balance

and optionnally:

- HomeCredit_columns_description

- sample_submission

Run python m000_xgboost_baseline.py to get a baseline score with just application_train/application_test

Run python m100_predictions.py to see the full pipeline in action.

Adding new features

If you want to edit a feature engineering step:

- Plain feature extraction is done in the files in

./src/feature_extraction - Feature engineering in

./src/feature_engineering

Each step accepts:

- train data

- test data

- labels/target

- database connection

- your folds

- a cache file

If you want to add a complete new step, follow one of the already existing examples.

The framework offers the following features:

-

@logspeeddecorator to log your step speed -

logger = logging.getLogger("HomeCredit")to load the commandline and CSV logger and display custom messages. - Cache the train and test results of your step. If you want to clear the cache edit and run

./del_from_cache.py - You can use the

ytarget labels andfoldsfor advanced out-of-folds predictions. I recommend you cache them afterwards. An example can be found in a very old version of this pipeline: https://github.com/mratsim/Apartment-Interest-Prediction/blob/master/src/transformers_nlp_tfidf.py#L42

Feature selection

In this example we built features from scratch but this framework also offers advanced feature selection similar to the sklearn-pandas package. See there: https://github.com/mratsim/meilleur-data-scientist-france-2018/blob/master/m110_feat_eng.py#L17-L36

select_feat = [

("encoded_etat", None),

("encoded_nom_magasin", None),

("prix", None),

("nb_images", None),

("longueur_image", None),

("largeur_image", None),

("poids", None),

("encoded_categorie", None),

("encoded_sous_categorie_1", None),

("encoded_sous_categorie_2", None),

("encoded_sous_categorie_3", None),

("encoded_sous_categorie_4", None),

("description_produit", [TfidfVectorizer(max_features=2**16,

min_df=2, stop_words='english',

use_idf=True),

TruncatedSVD(2)]),

("encoded_couleur", None),

("vintage", None)

]

and https://github.com/mratsim/meilleur-data-scientist-france-2018/blob/master/m000_baseline.py#L85

X_train, X_test = feat_selection(select_feat, X, X_test, y)

The None can be any Sklearn Rescaler, CategoricalEncoder or even a TfIDF + TruncatedSVD Sklearn pipeline

Description of the competition

Many people struggle to get loans due to insufficient or non-existent credit histories. And, unfortunately, this population is often taken advantage of by untrustworthy lenders.

Home Credit strives to broaden financial inclusion for the unbanked population by providing a positive and safe borrowing experience. In order to make sure this underserved population has a positive loan experience, Home Credit makes use of a variety of alternative data--including telco and transactional information--to predict their clients' repayment abilities.

While Home Credit is currently using various statistical and machine learning methods to make these predictions, they're challenging Kagglers to help them unlock the full potential of their data. Doing so will ensure that clients capable of repayment are not rejected and that loans are given with a principal, maturity, and repayment calendar that will empower their clients to be successful.

Fast to run and iterate

SQL

SQL databases are very optimized, multithreaded when critical, with index for O(log N) operations on critical path and operations on multiple fields can be grouped. In entreprise environment, SQL databases are also often installed on beefy servers.

⚠ Caution, spare your support team and DBA and don't run heavy SQL queries on production databases.

Furthermore, you can do feature engineering with any SQL editor with advanced previews, multiple panes:

Caching

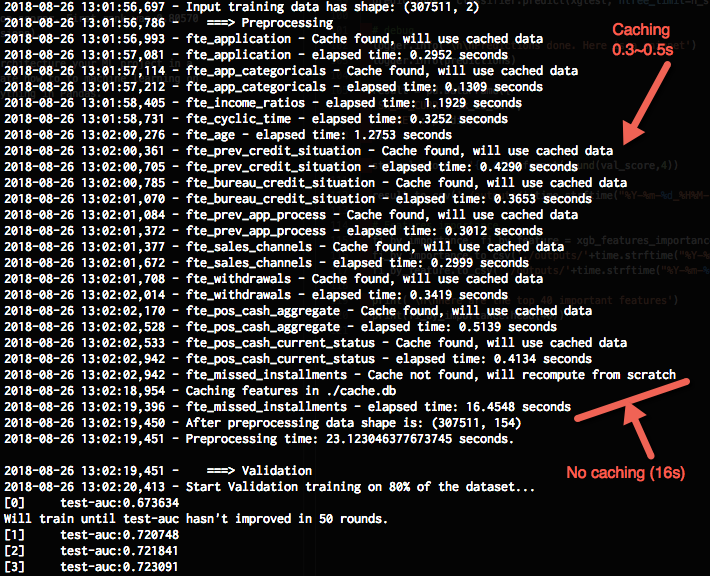

Every costly step of the pipeline can be cached using shelve from the Python standard library. This avoid having to recompute everything for small changes.

Comparision with Sklearn pipelines

While I started machine learning, I was pretty excited with Sklearn pipelines but after tinkering with them a lot they unfortunately came up short on many front:

- No caching

- No support for early stopping

- No out-of-fold predictions

- Unnecessary computation across folds:

- To avoid leaks on aggregate functions like "mean" or "median" based on target classes they make sure that only the current fold is retrieved and used in computation.

- In practice those are rare cases, you should bulk retrieve everything and do proper target encoding/crossval predictions on a as needed basis. On a 5 fold CV this will have 5 times less overhead.

- Procedural API/everything is a function (instead of a class), in theory the functions can be run in parallel (see the bottom of star_command.py)

Maintainable

Simple clean code

The code to achieve this is extremely simple, for example the credit card balance feature engineering is just the following:

- logger

-

@logspeeddecorator to log the speed of the feature engineering step - keys in the

shelvecache database - the SQL

# Copyright 2018 Mamy André-Ratsimbazafy. All rights reserved.

import logging

import pandas as pd

from src.instrumentation import logspeed

from src.cache import load_from_cache, save_to_cache

## Get the same logger from main"

logger = logging.getLogger("HomeCredit")

@logspeed

def fte_withdrawals(train, test, y, db_conn, folds, cache_file):

cache_key_train = 'fte_withdrawals_train'

cache_key_test = 'fte_withdrawals_test'

# Check if cache file exist and if data for this step is cached

train_cached, test_cached = load_from_cache(cache_file, cache_key_train, cache_key_test)

if train_cached is not None and test_cached is not None:

logger.info('fte_withdrawals - Cache found, will use cached data')

train = pd.concat([train, train_cached], axis = 1, copy = False)

test = pd.concat([test, test_cached], axis = 1, copy = False)

return train, test, y, db_conn, folds, cache_file

logger.info('fte_withdrawals - Cache not found, will recompute from scratch')

########################################################

def _trans(df, table, columns):

query = f"""

with instalments_per_app AS (

select

SK_ID_CURR,

max(CNT_INSTALMENT_MATURE_CUM) AS nb_installments

from

credit_card_balance

GROUP BY

SK_ID_CURR, SK_ID_PREV

ORDER BY

SK_ID_CURR

)

select

count(distinct SK_ID_PREV) as cb_nb_of_credit_cards,

avg(CNT_DRAWINGS_ATM_CURRENT) as cb_avg_atm_withdrawal_count,

avg(AMT_DRAWINGS_ATM_CURRENT) as cb_avg_atm_withdrawal_amount,

sum(AMT_DRAWINGS_ATM_CURRENT) as cb_sum_atm_withdrawal_amount,

avg(CNT_DRAWINGS_CURRENT) as cb_avg_withdrawal_count,

avg(AMT_DRAWINGS_CURRENT) as cb_avg_withdrawal_amount,

avg(CNT_DRAWINGS_POS_CURRENT) as cb_avg_pos_withdrawal_count,

avg(AMT_DRAWINGS_POS_CURRENT) as cb_avg_pos_withdrawal_amount,

avg(SK_DPD) as cb_avg_day_past_due,

avg(SK_DPD_DEF) as cb_avg_day_past_due_tolerated

--sum(nb_installments) as instalments_per_app

FROM

{table} app

left join

credit_card_balance ccb

on app.SK_ID_CURR = ccb.SK_ID_CURR

left join

instalments_per_app ipa

on ipa.SK_ID_CURR = ccb.SK_ID_CURR

--where

-- MONTHS_BALANCE BETWEEN -3 and -1

group by

ccb.sk_id_curr

ORDER by

app.SK_ID_CURR ASC

"""

df[columns] = pd.read_sql_query(query, db_conn)

columns = [

'cb_nb_of_credit_cards',

'cb_avg_atm_withdrawal_count',

'cb_avg_atm_withdrawal_amount',

'cb_sum_atm_withdrawal_amount',

'cb_avg_withdrawal_count',

'cb_avg_withdrawal_amount',

'cb_avg_pos_withdrawal_count',

'cb_avg_pos_withdrawal_amount',

'cb_avg_day_past_due',

'cb_avg_day_past_due_tolerated'

# 'instalments_per_app'

]

_trans(train, "application_train", columns)

_trans(test, "application_test", columns)

########################################################

logger.info(f'Caching features in {cache_file}')

train_cache = train[columns]

test_cache = test[columns]

save_to_cache(cache_file, cache_key_train, cache_key_test, train_cache, test_cache)

return train, test, y, db_conn, folds, cache_file

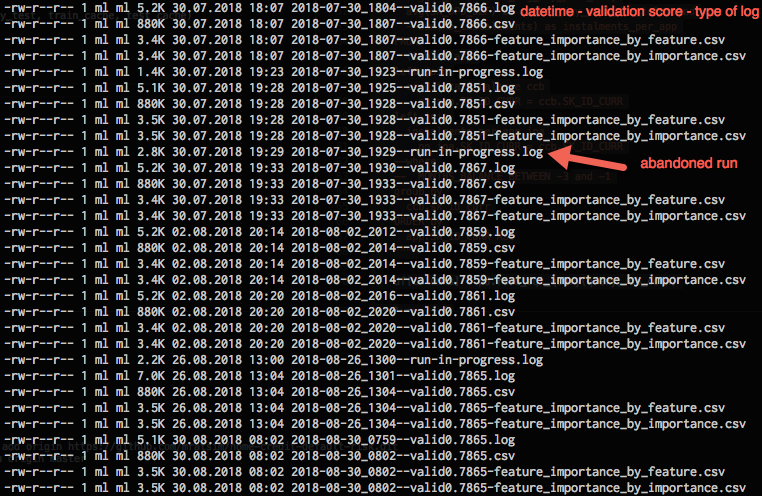

Keep track of experiments

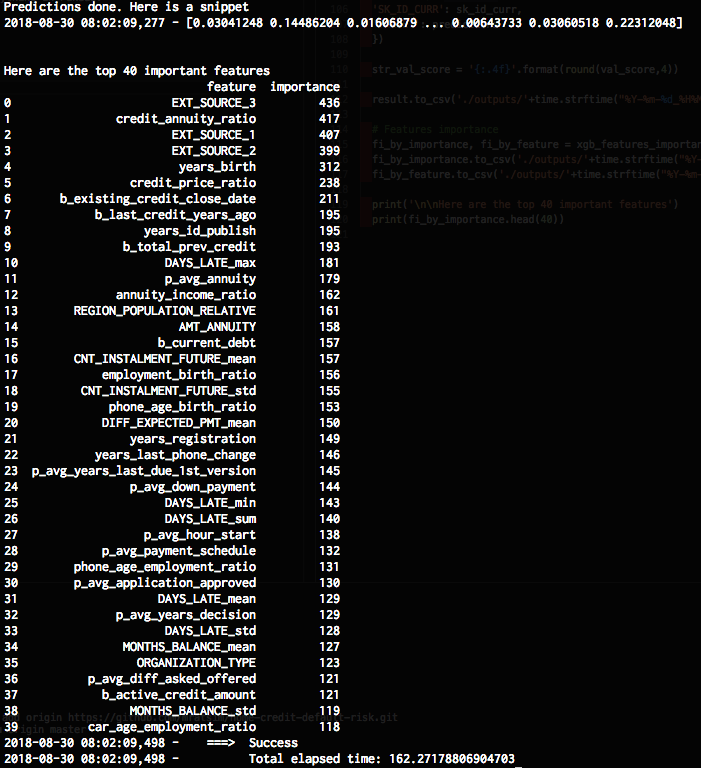

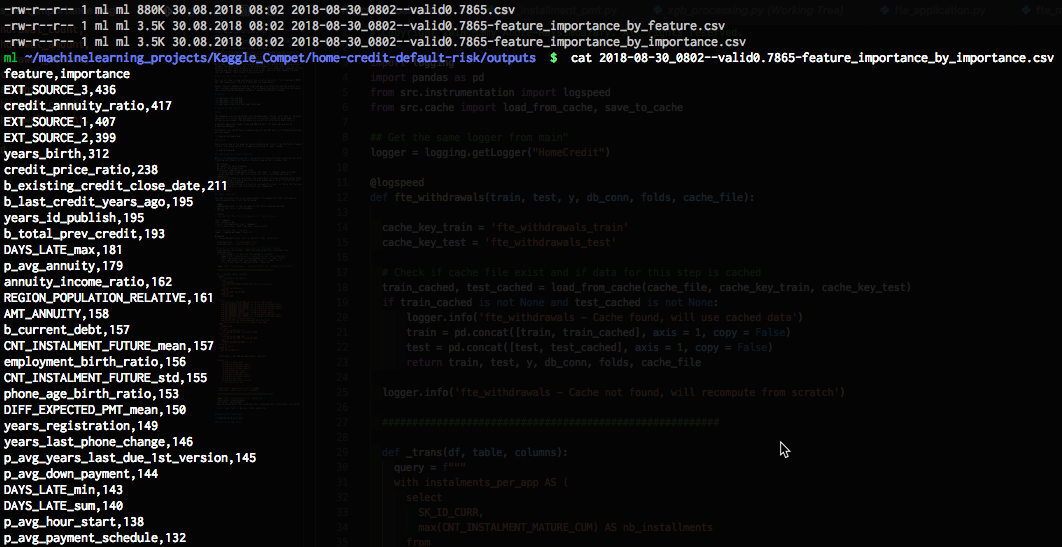

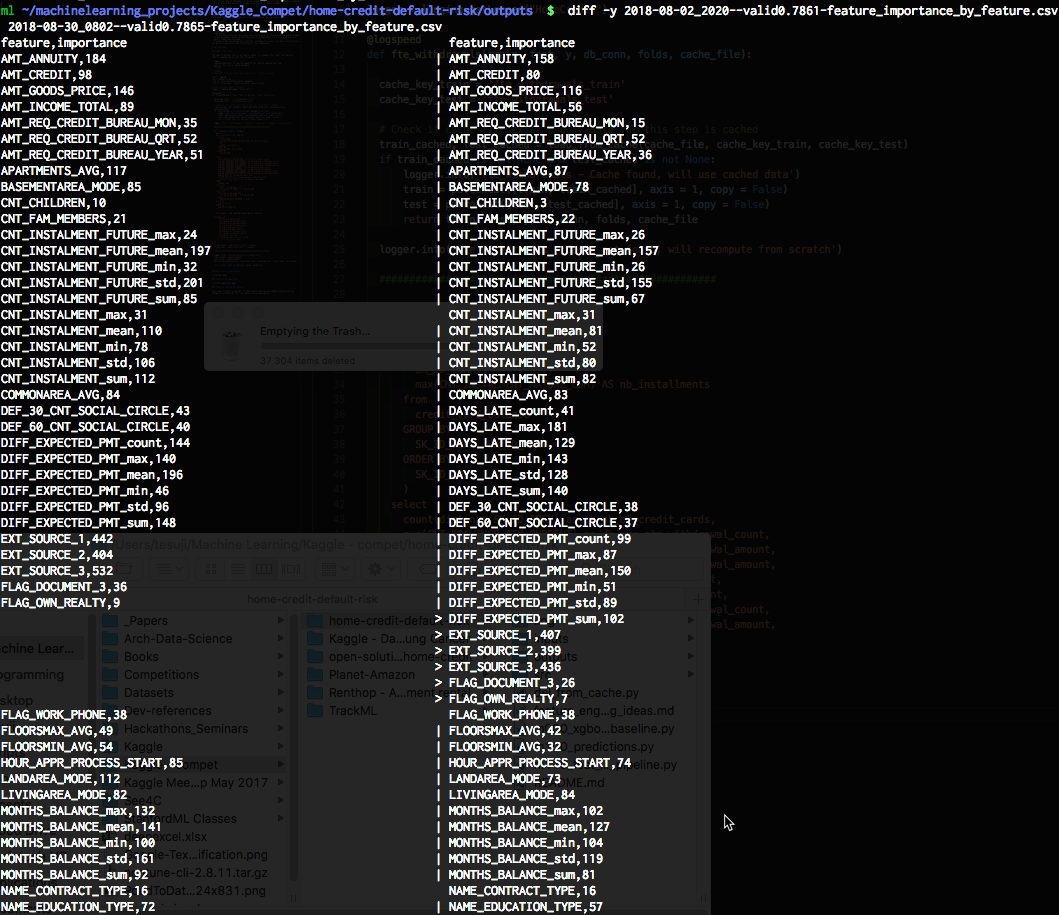

Features by importance

Features ordered by features

This makes it easy to use diff to check which features were added/removed and their change of influence on the final model across experiments

Scalable

-

All the instrumentation provided makes it much easier to keep track on what is going on and not have the dreaded "oh what did I change, I had a much better results previously". It also makes it much easier to collaborate on the same model.

-

Pipeline transformations are all done in a single file and can be easily commented in or out:

from src.star_command import feat_engineering_pipe from src.feature_engineering.fte_money import fte_income_ratios, fte_goods_price from src.feature_engineering.fte_cyclic_time import fte_cyclic_time from src.feature_engineering.fte_age import fte_age from src.feature_engineering.fte_money_bureau import fte_bureau_credit_situation from src.feature_engineering.fte_prev_app import fte_prev_credit_situation, fte_prev_app_process, fte_sales_channels from src.feature_engineering.fte_credit_balance import fte_withdrawals from src.feature_engineering.fte_pos_cash import fte_pos_cash_aggregate, fte_pos_cash_current_status from src.feature_engineering.fte_installment_pmt import fte_missed_installments from src.feature_extraction.fte_application import fte_application, fte_app_categoricals pipe_transforms = feat_engineering_pipe( fte_application, fte_app_categoricals, fte_income_ratios, fte_cyclic_time, fte_goods_price, fte_age, fte_prev_credit_situation, fte_bureau_credit_situation, fte_prev_app_process, fte_sales_channels, fte_withdrawals, fte_pos_cash_aggregate, fte_pos_cash_current_status, fte_missed_installments ) -

It supports sparse dataframes and being SQL based means that this can be done on big data and clusters.

Conclusion

I hope you learned something with this repo. Feel free to ask questions in Github issues.