saeed349 / Deep Reinforcement Learning In Trading

Stars: ✭ 129

Labels

Projects that are alternatives of or similar to Deep Reinforcement Learning In Trading

Glmm In Python

Generalized linear mixed-effect model in Python

Stars: ✭ 131 (+1.55%)

Mutual labels: jupyter-notebook

Google Colab Cloudtorrent

Colab Notebook Remote torrent client

Stars: ✭ 132 (+2.33%)

Mutual labels: jupyter-notebook

Sound localization algorithms

Classical algorithms of sound source localization with beamforming, TDOA and high-resolution spectral estimation.

Stars: ✭ 131 (+1.55%)

Mutual labels: jupyter-notebook

Deeplearningframeworks

Demo of running NNs across different frameworks

Stars: ✭ 1,652 (+1180.62%)

Mutual labels: jupyter-notebook

Python Feature Engineering Cookbook

Python Feature Engineering Cookbook, published by Packt

Stars: ✭ 130 (+0.78%)

Mutual labels: jupyter-notebook

Reinforcement Learning Implementation

Reinforcement Learning examples implementation and explanation

Stars: ✭ 131 (+1.55%)

Mutual labels: jupyter-notebook

Simpsonrecognition

Detect and recognize The Simpsons characters using Keras and Faster R-CNN

Stars: ✭ 131 (+1.55%)

Mutual labels: jupyter-notebook

3dmm Fitting

Fit 3DMM to front and side face images simultaneously.

Stars: ✭ 131 (+1.55%)

Mutual labels: jupyter-notebook

Rossmann tsa forecasts

Time Series Analysis & Forecasting of Rossmann Sales with Python. EDA, TSA and seasonal decomposition, Forecasting with Prophet and XGboost modeling for regression.

Stars: ✭ 131 (+1.55%)

Mutual labels: jupyter-notebook

Attic Climate

Mirror of Apache Open Climate Workbench

Stars: ✭ 131 (+1.55%)

Mutual labels: jupyter-notebook

Zerodha live automate trading using ai ml on indian stock market Using Basic Python

Online trading using Artificial Intelligence Machine leaning with basic python on Indian Stock Market, trading using live bots indicator screener and back tester using rest API and websocket 😊

Stars: ✭ 131 (+1.55%)

Mutual labels: jupyter-notebook

Tensorflow realtime multi Person pose estimation

Multi-Person Pose Estimation project for Tensorflow 2.0 with a small and fast model based on MobilenetV3

Stars: ✭ 129 (+0%)

Mutual labels: jupyter-notebook

Kaggle earthquake challenge

This is the code for the Kaggle Earthquake Challenge by Siraj Raval on Youtube

Stars: ✭ 132 (+2.33%)

Mutual labels: jupyter-notebook

Breakthrough

UC Berkeley's software and documentation for Breakthrough Listen data

Stars: ✭ 131 (+1.55%)

Mutual labels: jupyter-notebook

Security Api Solutions

Microsoft Graph Security API applications and services.

Stars: ✭ 132 (+2.33%)

Mutual labels: jupyter-notebook

Huawei Digix Agegroup

2019 HUAWEI DIGIX Nurbs Solutions

Stars: ✭ 132 (+2.33%)

Mutual labels: jupyter-notebook

Team Learning Nlp

主要存储Datawhale组队学习中“自然语言处理”方向的资料。

Stars: ✭ 132 (+2.33%)

Mutual labels: jupyter-notebook

Deep Reinforcement Learning for Trading

This repository provides the code for a Reinforcement Learning trading agent with its trading environment that works with both simulated and historical market data. This was inspired by OpenAI Gym framework.

This repository has the Keras implementation of

Requirements

- Python 3.5/3.6

- Keras

- Tensorflow

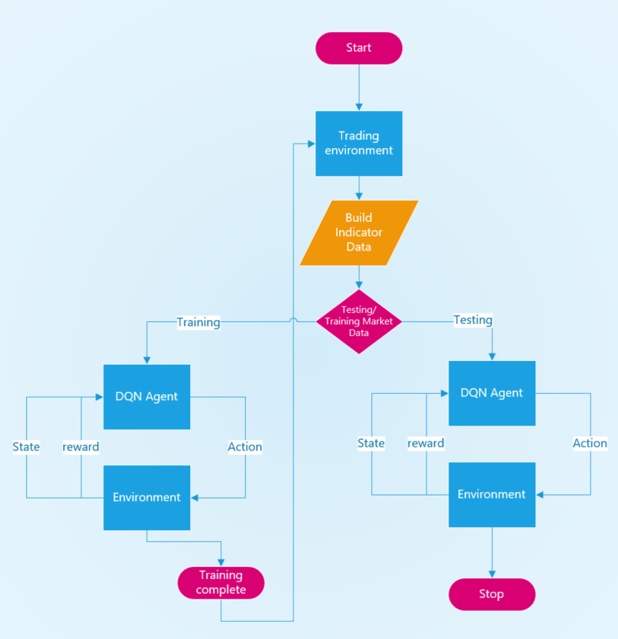

Workflow

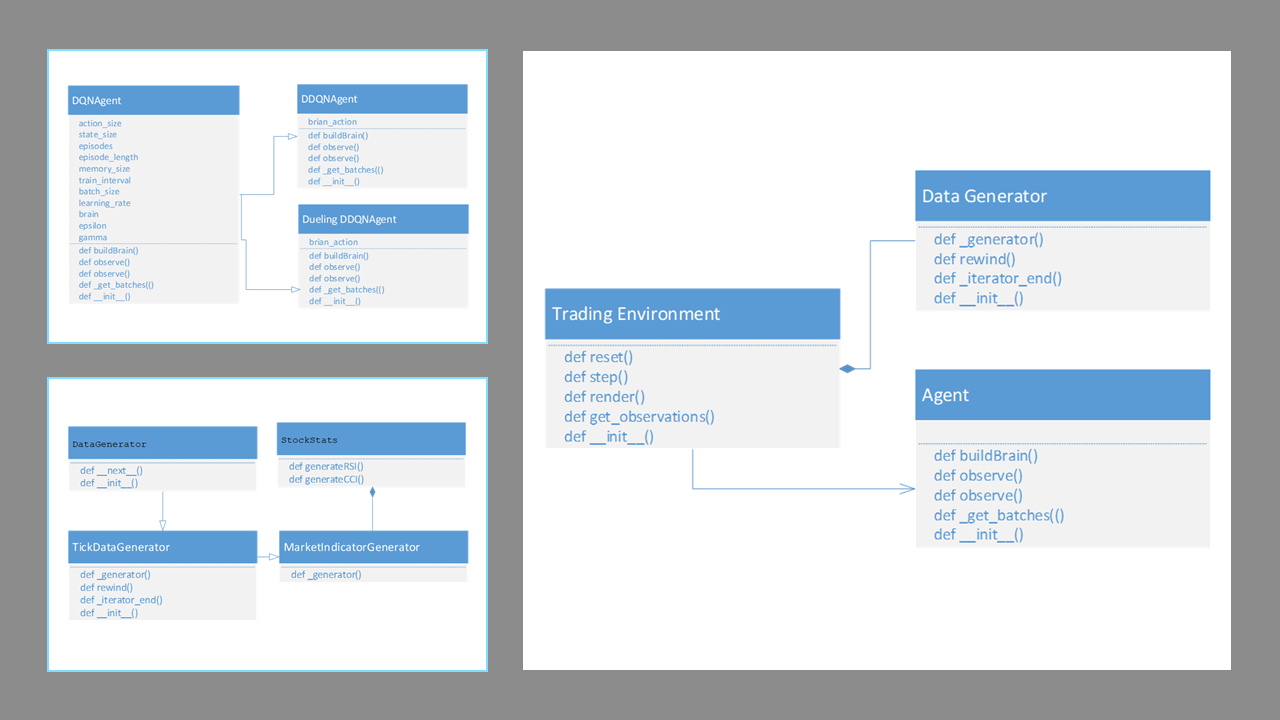

Architecture

Features

- 3 Reinforcement learning Agents (DQN, DDQN, DDDQN)

- ADX and RSI technical indicator and extensible for more

- Historical stock market data ingestion through CSV

Policy

State

[𝐴𝐷𝑋(𝑡), 𝑅𝑆𝐼(𝑡), 𝐶𝐶𝐼(𝑡), 𝑝𝑜𝑠𝑖𝑡𝑖𝑜𝑛, 𝑢𝑛𝑟𝑒𝑎𝑙𝑖𝑧𝑒𝑑 𝑟𝑒𝑡𝑢𝑟𝑛]

Action

The agent could take three actions – Buy, Sell or Hold

Reward

The reward objective is set to maximize realized PnL from a round trip trade. It also includes

- Trading commision (penalty)

- Holding fee (penalty), like the interest brokers charge for overnight levereg position. These rewards are what controls and optimize the agents during the training phase that determines the trading behavior. The latter 2 parameters control the trading frequncy of the agent.

What's next?

- Prioritized Experience Replay

- LSTM networks

- Asynchronous Advantage Actor-Critic (A3C)

- Multi-agent

- Reward engineering

Note that the project description data, including the texts, logos, images, and/or trademarks,

for each open source project belongs to its rightful owner.

If you wish to add or remove any projects, please contact us at [email protected].