|

hyperdrive: an algorithmic trading library |

|---|

hyperdrive is an algorithmic trading library that powers quant research firm ![]() forcepu.sh.

forcepu.sh.

Unlike other backtesting libraries, hyperdrive specializes in data collection and quantitative research.

In the examples below, we explore how to:

- store market data

- create trading strategies

- test strategies against historical data (backtesting)

- execute orders.

Getting Started

Prerequisites

You will need Python 3.8+

Installation

To install the necessary packages, run

pythom -m pip install hyperdrive -U

Examples

Most secrets must be passed as environment variables. Future updates will allow secrets to be passed directly into class object (see example on order execution).

1. Storing data

Pre-requisites:

- an IEXCloud or Polygon API key

- an AWS account and an S3 bucket

Environment Variables:

IEXCLOUDorPOLYGONAWS_ACCESS_KEY_IDAWS_SECRET_ACCESS_KEYAWS_DEFAULT_REGIONS3_BUCKET

from hyperdrive import DataSource

from DataSource import IEXCloud, MarketData

# IEXCloud API token loaded as an environment variable (os.environ['IEXCloud'])

symbol = 'TSLA'

timeframe = '7d'

md = MarketData()

iex = IEXCloud()

iex.save_ohlc(symbol=symbol, timeframe=timeframe)

df = md.get_ohlc(symbol=symbol, timeframe=timeframe)

print(df)

Output:

Time Open High Low Close Vol

2863 2021-11-10 1010.41 1078.1000 987.31 1067.95 42802722

2864 2021-11-11 1102.77 1104.9700 1054.68 1063.51 22396568

2865 2021-11-12 1047.50 1054.5000 1019.20 1033.42 25573148

2866 2021-11-15 1017.63 1031.9800 978.60 1013.39 34775649

2867 2021-11-16 1003.31 1057.1999 1002.18 1054.73 26542359

2. Creating a model

Much of this code is still closed-source, but you can take a look at the Historian class in the History module for some ideas.

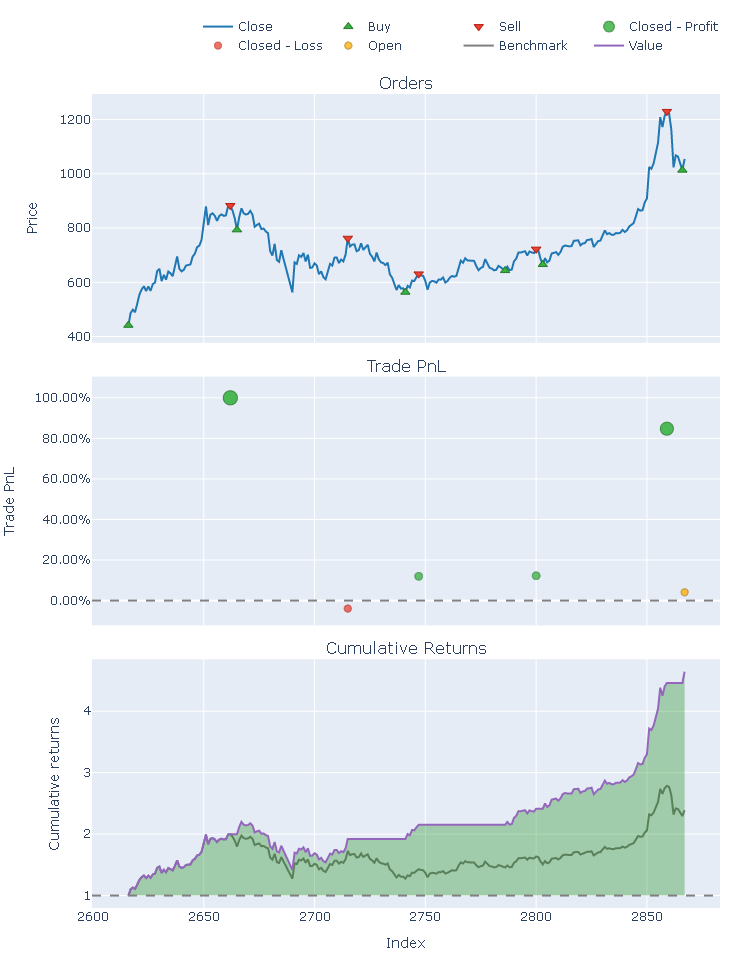

3. Backtesting a strategy

We use vectorbt to backtest strategies.

from hyperdrive import History, DataSource, Constants as C

from History import Historian

from DataSource import MarketData

hist = Historian()

md = MarketData()

symbol = 'TSLA'

timeframe = '1y'

df = md.get_ohlc(symbol=symbol, timeframe=timeframe)

holding = hist.buy_and_hold(df[C.CLOSE])

signals = hist.get_optimal_signals(df[C.CLOSE])

my_strat = hist.create_portfolio(df[C.CLOSE], signals)

metrics = [

'Total Return [%]', 'Benchmark Return [%]',

'Max Drawdown [%]', 'Max Drawdown Duration',

'Total Trades', 'Win Rate [%]', 'Avg Winning Trade [%]',

'Avg Losing Trade [%]', 'Profit Factor',

'Expectancy', 'Sharpe Ratio', 'Calmar Ratio',

'Omega Ratio', 'Sortino Ratio'

]

holding_stats = holding.stats()[metrics]

my_strat_stats = my_strat.stats()[metrics]

print(f'Buy and Hold Strat\n{"-"*42}')

print(holding_stats)

print(f'My Strategy\n{"-"*42}')

print(my_strat_stats)

# holding.plot()

my_strat.plot()

Output:

Buy and Hold Strat

------------------------------------------

Total Return [%] 138.837436

Benchmark Return [%] 138.837436

Max Drawdown [%] 36.246589

Max Drawdown Duration 186 days 00:00:00

Total Trades 1

Win Rate [%] NaN

Avg Winning Trade [%] NaN

Avg Losing Trade [%] NaN

Profit Factor NaN

Expectancy NaN

Sharpe Ratio 2.206485

Calmar Ratio 6.977133

Omega Ratio 1.381816

Sortino Ratio 3.623509

Name: Close, dtype: object

My Strategy

------------------------------------------

Total Return [%] 364.275727

Benchmark Return [%] 138.837436

Max Drawdown [%] 35.49422

Max Drawdown Duration 122 days 00:00:00

Total Trades 6

Win Rate [%] 80.0

Avg Winning Trade [%] 52.235227

Avg Losing Trade [%] -3.933059

Profit Factor 45.00258

Expectancy 692.157004

Sharpe Ratio 4.078172

Calmar Ratio 23.220732

Omega Ratio 2.098986

Sortino Ratio 7.727806

Name: Close, dtype: object

4. Executing an order

Pre-requisites:

- a Binance.US API key

Environment Variables:

BINANCE

from pprint import pprint

from hyperdrive import Exchange

from Exchange import Binance

# Binance API token loaded as an environment variable (os.environ['BINANCE'])

bn = Binance()

# use 45% of your USD account balance to buy BTC

order = bn.order('BTC', 'USD', 'BUY', 0.45)

pprint(order)

Output:

{'clientOrderId': '3cfyrJOSXqq6Zl1RJdeRRC',

'cummulativeQuoteQty': 46.8315,

'executedQty': 0.000757,

'fills': [{'commission': '0.0500',

'commissionAsset': 'USD',

'price': '61864.6400',

'qty': '0.00075700',

'tradeId': 25803914}],

'orderId': 714855908,

'orderListId': -1,

'origQty': 0.000757,

'price': 0.0,

'side': 'SELL',

'status': 'FILLED',

'symbol': 'BTCUSD',

'timeInForce': 'GTC',

'transactTime': 1637030680121,

'type': 'MARKET'}

Use

Use the scripts provided in the scripts/ directory as a reference since they are actually used in production daily.

Available data collection functions:

-

(from Robinhood)

-

(from IEXCloud and Polygon)

-

(from IEXCloud and Polygon)

-

(from IEXCloud and Polygon)

-

(from IEXCloud and Polygon)

-

(from StockTwits)

-

(from the Bureau of Labor Statistics)