junosan / Sibyl

Labels

Projects that are alternatives of or similar to Sibyl

Sibyl

Sibyl (Simulation of Intraday Book and Yield with Limit-orders) is a platform for backtesting and live-trading with real-time intraday Stock/ETF/ELW data, with a special focus on training and evaluating recurrent neural networks (RNNs) for forming trade signals.

It adopts a server/client model with a TCP communication channel, allowing exactly the same code to be used for both backtesting and live-trading, on distributed systems or within the same system.

- Server side

- backtesting simulator

- agent for relaying order request/status to/from a broker

- Client side

- order request generators using RNNs (for real-time)

- order request generators using pre-calculated reference target signals (for testing)

Requirements

Project was developed using g++ 5.4.0 with -std=c++11.

Version numbers are not hard requirements.

RNN backends

-

Fractal (commit

261f1fd) : based on C++/CUDA; faster than Sophia -

Sophia (commit

3ab4359) : based on Python/Theano; less VRAM usage than Fractal, and more flexibility in experimental RNN structures- Theano (0.9.0b1) with libgpuarray (0.6.0) : symbolic computation library for multi-dimensional arrays

-

ZeroMQ (4.2.0)

with C++ binding (commit

1fdf3d1) : messaging library, used for real-time inference using RNNs trained by Sophia via interprocess communication (IPC) or over a network (TCP)

Fractal is required, Sophia (Theano, ZeroMQ) is optional. With regards to backtesting/live-trading, both function identically.

Common

- Eigen (3.3.2) : Linear algebra library, used for data preprocessing

Broker frontends (optional)

This project has been tested extensively in South Korean KOSPI market using Kiwoom Securities OpenAPI. Following two repositories provide frontends for collecting real-time data and executing live trades through this broker.

- KiwoomScribe : collect level 1 (top of the book quotes and trades) and partial level 2 (order book up to ±10 ticks) Stock/ETF/ELW data with 1 second resolution

- KiwoomAgent : relay order requests from Sibyl to the market, and market data & order status updates from the market to Sibyl

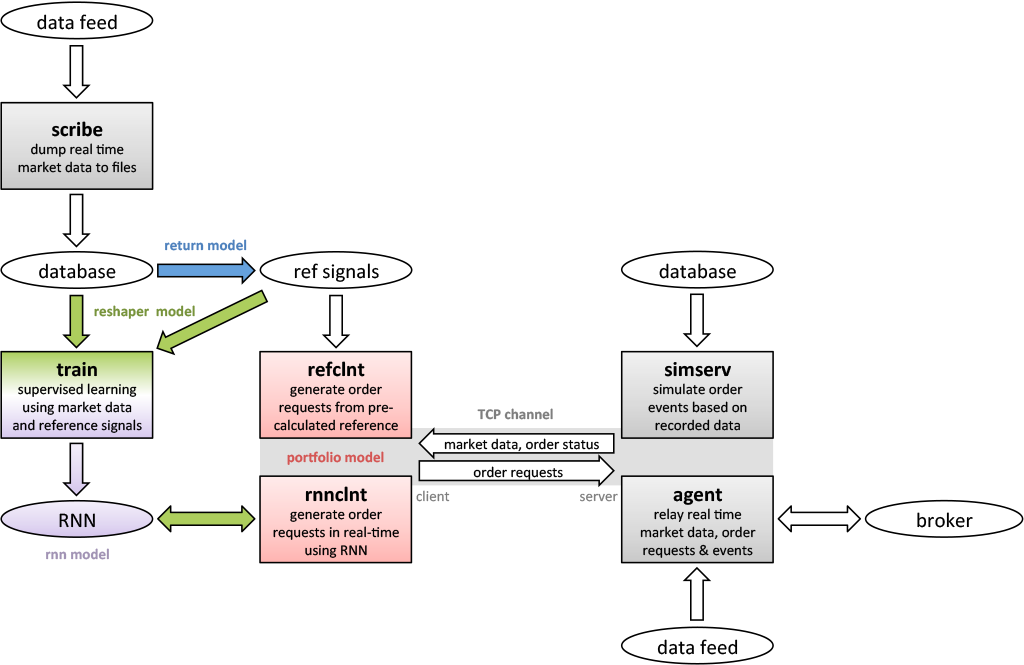

Block diagram

The procedure for data collection, modeling, training, backtesting, and live-trading are summarized in the following diagram.

There are 4 constituents of a trading model in this diagram:

- Return model : given the state (possibly also including past and future states) of a security, determines expected return of an action; this is not a part of this repository

-

Reshaper model

: process input & target/output of RNN in a way that makes more sense

for an RNN to learn;

class Reshaperinsrc/core/rnnand its derived classes -

RNN model

: given preprocessed input, generate output, which becomes a real-time

estimation of the target after Reshaper processing;

class TradeNetinsrc/core/rnnand its derived classes -

Portfolio model

: given a set of returns of different security items, determines the price,

size, and timing of order requests;

class Modelinsrc/core/sibyl/clientand its derived classes

Programs in this repository

Common:

- simserv: backtesting simulation server

- refclnt: send order requests from pre-calculated reference target signals; intended for testing portfolio strategies

For Fractal:

- train: train an RNN using Fractal

- rnnclnt: send real-time order requests using RNNs trained by Fractal

For Sophia:

-

sophia: send real-time order requests using RNNs trained by Sophia

via interprocess communication (IPC) or over a network (TCP)

with

sophia.py; equivalent to rnnclnt (Sophia's train.py is equivalent to train) - reshape_dataset: batch preprocess (Reshaper model) data in suitable format for Sophia

How to use

Sample data

Releases page includes sample data and pre-trained RNNs to demonstrate the backtesting feature. To try them,

- See Directory structure section below

- Install the prerequisite libraries/repositories;

Fractal and Eigen are required, Sophia (Theano, ZeroMQ) is optional

-

Fractal (requires CUDA)

- Install to

/usr/local/{include,lib} - If the compiler generates an error about

isnanduring building, replace the noted part withstd::isnan

- Install to

-

Sophia (requires Theano & CUDA)

- Clone to

$ROOT/Sophia/src - Make sure Theano (including libgpuarray) is

installed properly;

THEANO_FLAGS=device=cuda0 python -c "import pygpu; import theano"should not generate any error -

ZeroMQ: install to

/usr/local/{include,lib}; cppzmq is header-only and should be installed to/usr/local/include

- Clone to

-

Eigen: header-only; install to

/usr/local/include/Eigen

-

Fractal (requires CUDA)

- Extract and put the data files and RNN models in their respective directories

- Zipped market data as

$ROOT/MATLAB/Data/$DATE.zip - RNN workspace directories as

$ROOT/workspace/$WORKSPACE_NAME

- Zipped market data as

- See Backtesting sections below for launching backtests with either

Fractal or Sophia

- Compile

simservandrnnclnt/sophia - Script files and config files in

run/rnn(for Fractal) andrun/sophia(for Sophia) are preconfigured to launch backtests on the sample data with appropriate model parameters - In either directory, run

./run_g_list.sh date.list

- Compile

- On a different window or in

screenortmux,watch -n1 cat $ROOT/Sibyl/bin/state/client_cur.logwhile the client is running to monitor the progress - Using

net.shinrun/rnnorrun/sophiaalong with KiwoomAgent will launch live-trading with exactly the same Return/Reshaper/RNN/Portfolio model - DISCLAIMER: as is clearly stated in Clause 7 and Clause 8 of LICENSE, the Apache-2.0 license, this material is provided WITHOUT WARRANTIES OR CONDITIONS OF ANY KIND, in particular regarding its FITNESS FOR A PARTICULAR PURPOSE; I shall not be liable for ANY damage, direct or indirect, that may occur as a result of using this software; please see LICENSE for the exact legal language regarding this disclaimer

Directory structure

The script files included in directory run show how to train,

backtest, and execute live trades.

They assume the following directory structure.

MATLAB is just a name here, and is not a requirement.

$ROOT (a base directory, not /)

MATLAB

Data (zipped plain text market data for each date)

DataV (zipped transformed binary data for each date)

fractal

DataV (unzipped and split into train/dev set for training)

Sibyl (this repository, cloned)

src (source code)

run (script and config files)

bin (compiled binary)

Sophia

src (Sophia repository, cloned)

run (script files for training)

reshaped_dataset (batch preprocessed data for Sophia)

workspace (RNN models saved here)

Preparing data

This repository does not contain materials for preparing the data, but it is still discussed below for completeness.

Collecting real-time intraday market data

See KiwoomScribe for data format.

KiwoomScribe collects ca. 500 security items per day, and each security

item comprises 2 to 4 plain text files (trade events, order book events, etc).

Data is ca. 30 MB compressed (ca. 900 MB raw) for each date.

Zipped for each date and placed in $ROOT/MATLAB/Data as $YYYYMMDD.zip.

Converting market data to .raw/.ref files (Return model)

These are binary files for training RNNs.

See src/core/rnn/TradeDataSet.cc for binary data formats.

The implementation of transformation from raw market data to these files

is not a part of this repository.

-

.raw: vectorized raw market data; after preprocessing byclass Reshaper, becomes the input for RNN -

.ref: reference trade signals derived from market data; after preprocessing byclass Reshaper, becomes the target for RNN

Zipped for each date and placed in $ROOT/MATLAB/DataV as $YYYYMMDD.zip,

containing data for specific security items of interest to be fed to RNNs

for training.

Splitting train/dev/test sets

Use script files in $ROOT/MATLAB/fractal

(these script files are contained in sample_data.tar.gz)

- (Optional) Run

gen_rand_datalist.shandparse_datalist.shto randomly designate specific dates to be put in dev set (stored asdevset.txt) - Edit and run

prepare_data.sh- this unzips the files from

$ROOT/MATLAB/DataVto$ROOT/MATLAB/fractal/DataVand creates a sequence listlist.txt - make sure only the binary data for train + dev set are in

$ROOT/MATLAB/DataV(binary data aren't needed for the test set)

- this unzips the files from

- Edit and run

split_dataset.sh- this takes a list of dates to be put in the dev set from

devset.txtand splits the dataset - results are two files

train.listanddev.listcontaining relative paths (excluding extension) to the sequences in each dataset - this dataset is used both for Fractal and Sophia;

for Sophia, an additional

reshape_datasetstep is needed -- see below

- this takes a list of dates to be put in the dev set from

Training/backtesting/live-trading using Fractal

Training

- Compile

trainfrom$ROOT/Sibyl/src/train- choose the TradeNet (which defines the neural net architecture) and

Reshaper in

train.cc -

make clean, thenmake - assumes required libraries installed in the global zone

(

/usr/local/include,/usr/local/lib)

- choose the TradeNet (which defines the neural net architecture) and

Reshaper in

- Run

$ROOT/Sibyl/run/train/train_batch_0.sh- set paths of binaries, dataset, and workspace in the script file

- multiple training sessions can be queued to be run in sequence

- multiple training sessions can be run simultaneously if you have

multiple GPUs; see

$ROOT/Sibyl/run/train/train_batch_1.sh

Backtesting

- Compile

simservfrom$ROOT/Sibyl/src/simservwithmake - Compile

rnnclntfrom$ROOT/Sibyl/src/rnnclnt- choose the TradeNet and Reshaper in

rnnclnt.cc; these should be the same as those chosen during training -

make clean, thenmake

- choose the TradeNet and Reshaper in

- Use script files in

$ROOT/Sibyl/run/rnn-

run_g.sh: runs backtest for a single date$1-

workspace.listspecifies which trained RNN to use (can run multiple RNNs in ensemble) -

simserv,class Model, andclass Reshapereach take a configuration file as referred to inrun_g.sh, which need to be modified as needed - see Screenshots section below for instructions on live monitoring

-

-

run_g_list.sh: usingrun_g.sh, run all dates in a date list file$1 -

run_g_scan_param.sh: usingrun_g_list.sh, repeatedly run full date list while changing configuration files (for performing parameter optimization)

-

Live-trading

- Launch an agent (e.g., KiwoomAgent), possibly on a different machine

- Run

$ROOT/Sibyl/run/rnn/net.sh- set address & port of the agent's machine in the script file

- set configuration files referred to in the script file

Training/backtesting/live-trading using Sophia

Training

- Compile

reshape_datasetfrom$ROOT/Sibyl/src/reshape_dataset- choose the Reshaper in

reshape_dateset.cc -

make clean, thenmake

- choose the Reshaper in

- Run

$ROOT/Sibyl/run/reshape_dataset/reshape.shafter setting paths in the script file- this assumes data prepared as specified in Preparing data section above

- Run

$ROOT/Sophia/run/train_0.sh- neural net structure is configured directly in

$ROOT/Sophia/src/train.py - similar to above, multiple training sessions can be run in sequence or in parallel

- neural net structure is configured directly in

Backtesting/live-trading

- Compile

simservfrom$ROOT/Sibyl/src/simservwithmake - Compile

sophiafrom$ROOT/Sibyl/src/sophia- choose the Reshaper in

sophia.cc; should be the same as that for training -

make clean, thenmake

- choose the Reshaper in

- Use script files in

$ROOT/Sibyl/run/sophia- they function identically to those in

$ROOT/Sibyl/run/rnn

- they function identically to those in

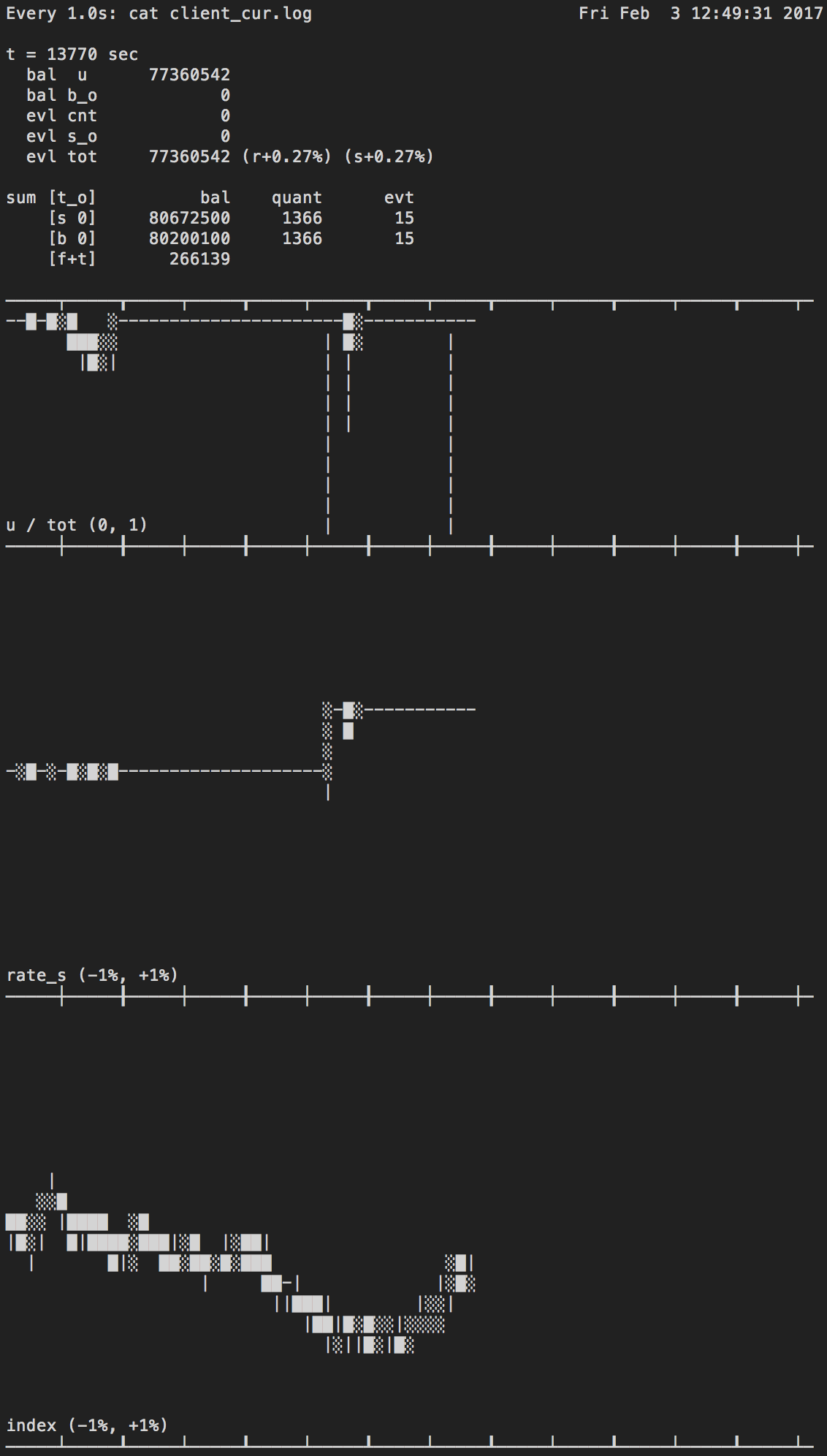

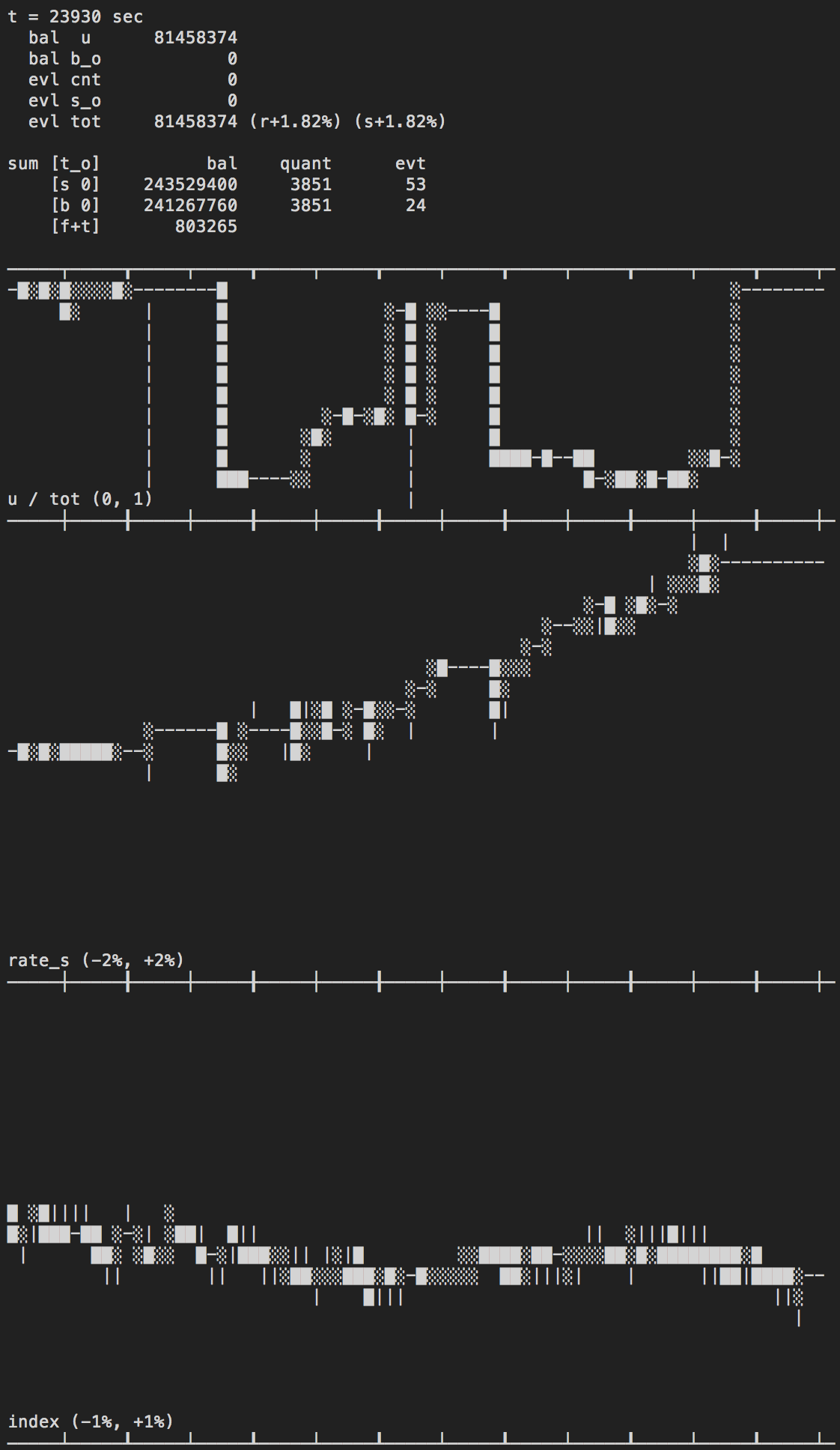

Screenshots

While operating, client updates $ROOT/Sibyl/bin/state/client_cur.log

in real-time to show a summary of what's going on.

This file can be watch cat'ed in the terminal to monitor the current state

of backtesting/live-trading (requires UTF-8 support in the terminal emulator).

Note that this is only meant to be a quick-glance summary; full logs are

stored in $ROOT/Sibyl/bin/log, in human-readable and binary formats.

Sample screenshots from some different models:

Statistics legend

-

bal u: unused balance -

bal b_o: balance staged as buy orders -

evl cnt: estimated value of securities in hand, not staged in the market -

evl s_o: estimated value of securities staged as sell orders -

evl tot: grand total -

r+#.##%: profit rate wrt the reference prices (last date's ending prices) -

s+#.##%: profit rate wrt the starting prices -

bal/quant/evt: balance (or estimated value)/quantity/events -

[t_o]: original relative price tick at which orders were placed -

[s 0]: at immediate sell price (ps0= highest bid price) -

[b 0]: at immediate buy price (pb0= lowest ask price) -

[f+t]: fee + taxes

Screenshots above show statistics only for the 0-th relative price ticks (immediate orders only), as only these were assumed in the Return/Portfolio/Reshaper models in use. However, the simulator is able to handle arbitrarily priced limit-orders within the collected tick data range.

Charts legend

- top chart (

u / tot): ratio of unused balance - middle chart (

rate_s): profit rate wrt the starting prices (in %, auto-scales) - bottom chart (

index): market's main index (in above screenshots, KOSPI200) - x-axis: major tick - 1 hour, minor tick - 30 minutes; starts at 09:00:00

-

░: between starting/ending values of a rising segment -

█: between starting/ending values of a falling segment -

|: between high/low values of a segment (if not masked by above) -

-: no change