jasonstrimpel / Volatility Trading

A complete set of volatility estimators based on Euan Sinclair's Volatility Trading

Stars: ✭ 538

Programming Languages

python

139335 projects - #7 most used programming language

Projects that are alternatives of or similar to Volatility Trading

Algotrader

Simple algorithmic stock and option trading for Node.js.

Stars: ✭ 468 (-13.01%)

Mutual labels: trading, options

Lean

Lean Algorithmic Trading Engine by QuantConnect (Python, C#)

Stars: ✭ 5,675 (+954.83%)

Mutual labels: options, trading

Go Robinhood

A golang library for interacting with the Robinhood private API

Stars: ✭ 48 (-91.08%)

Mutual labels: trading, options

Tradingview Trainer

A lightweight app for practicing your trading on Tradingview

Stars: ✭ 106 (-80.3%)

Mutual labels: trading, options

Trade Frame

c++ based application for testing options based automated trading ideas using DTN IQ real time data feed and Interactive Brokers (TWS API) for trade execution.

Stars: ✭ 187 (-65.24%)

Mutual labels: trading, options

Turingtrader

The Open-Source Backtesting Engine/ Market Simulator by Bertram Solutions.

Stars: ✭ 132 (-75.46%)

Mutual labels: trading, options

Optionsuite

Option and stock backtester / live trader

Stars: ✭ 58 (-89.22%)

Mutual labels: trading, options

SierraChartZorroPlugin

A Zorro broker API plugin for Sierra Chart, written in Win32 C++.

Stars: ✭ 22 (-95.91%)

Mutual labels: options, trading

Optopsy

A nimble options backtesting library for Python

Stars: ✭ 373 (-30.67%)

Mutual labels: trading, options

Ta4j Origins

A Java library for technical analysis ***Not maintained anymore, kept for archival purposes, see #192***

Stars: ✭ 354 (-34.2%)

Mutual labels: trading

Quantdom

Python-based framework for backtesting trading strategies & analyzing financial markets [GUI ]

Stars: ✭ 449 (-16.54%)

Mutual labels: trading

Tribeca

A high frequency, market making cryptocurrency trading platform in node.js

Stars: ✭ 3,646 (+577.7%)

Mutual labels: trading

Crypto Exchanges Gateway

Your gateway to the world of crypto !

Stars: ✭ 343 (-36.25%)

Mutual labels: trading

Wolfbot

Crypto currency trading bot written in TypeScript for NodeJS

Stars: ✭ 335 (-37.73%)

Mutual labels: trading

Rqalpha

A extendable, replaceable Python algorithmic backtest && trading framework supporting multiple securities

Stars: ✭ 4,425 (+722.49%)

Mutual labels: trading

volest

A complete set of volatility estimators based on Euan Sinclair's Volatility Trading.

http://www.amazon.com/gp/product/0470181990/tag=quantfinancea-20

The original version incorporated network data acquisition from Yahoo!Finance

from pandas_datareader. Yahoo! changed their API and broke pandas_datareader.

The changes allow you to specify your own data so you're not tied into equity

data from Yahoo! finance. If you're still using equity data, just download

a CSV from finance.yahoo.com and use the data.yahoo_data_helper method

to form the data properly.

Volatility estimators include:

- Garman Klass

- Hodges Tompkins

- Parkinson

- Rogers Satchell

- Yang Zhang

- Standard Deviation

Also includes

- Skew

- Kurtosis

- Correlation

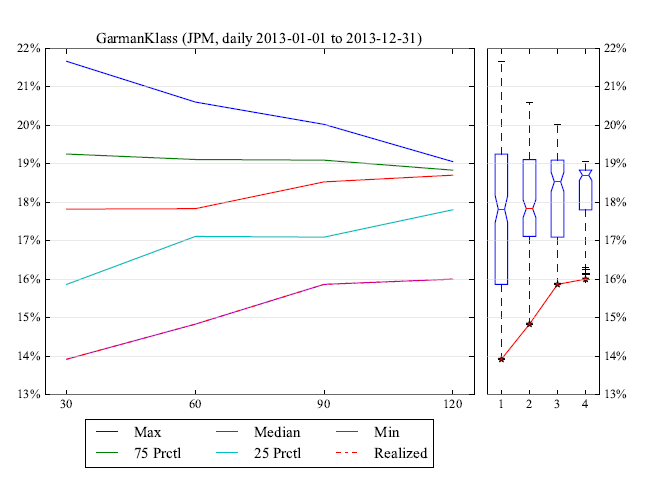

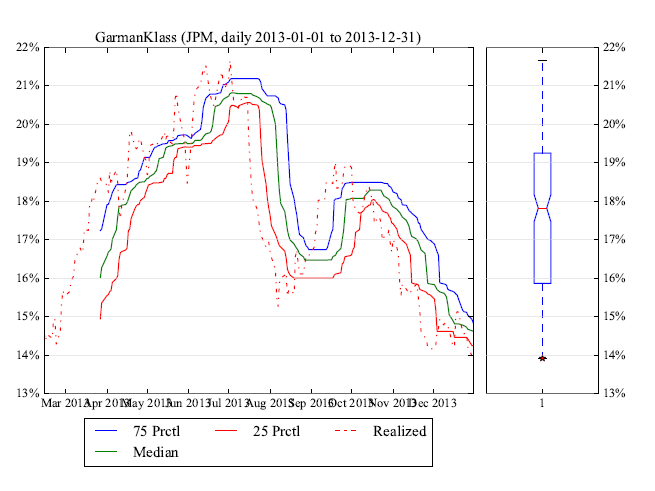

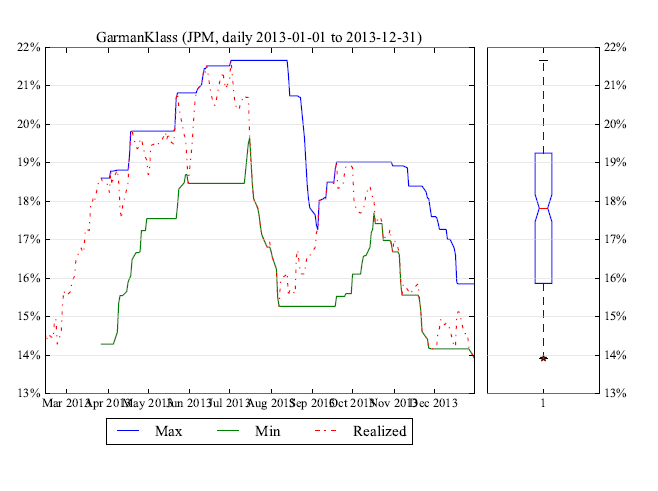

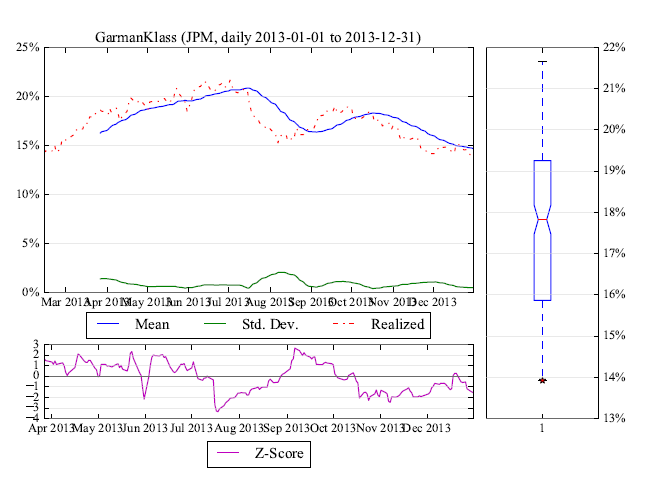

For each of the estimators, plot:

- Probability cones

- Rolling quantiles

- Rolling extremes

- Rolling descriptive statistics

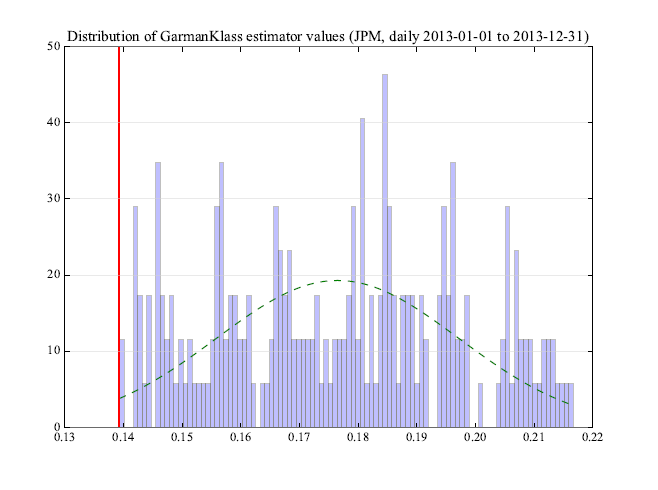

- Histogram

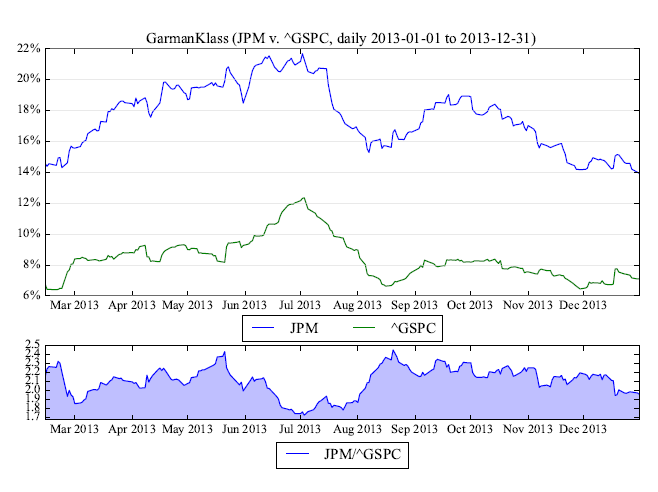

- Comparison against arbirary comparable

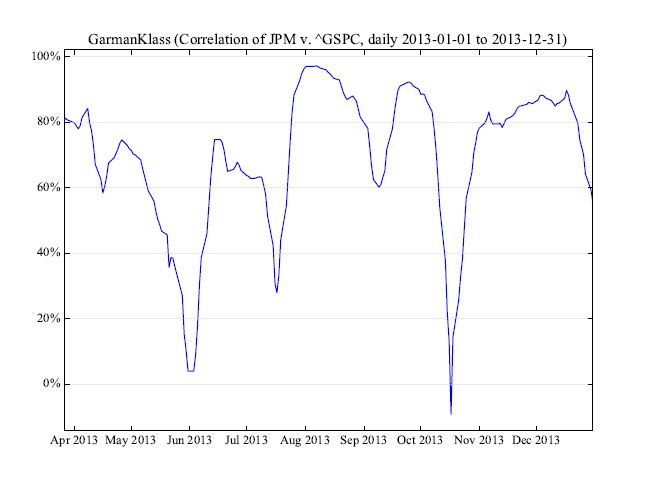

- Correlation against arbirary comparable

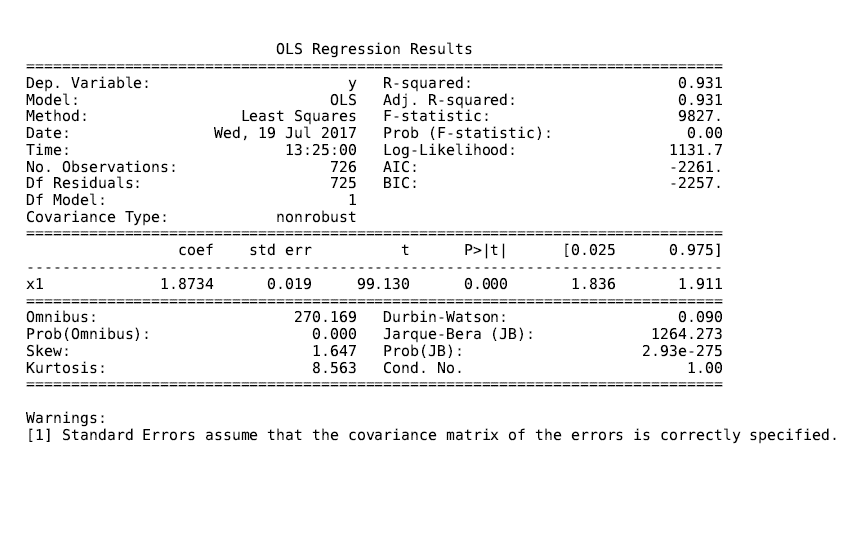

- Regression against arbirary comparable

Create a term sheet with all the metrics printed to a PDF.

Page 1 - Volatility cones

Page 2 - Volatility rolling percentiles

Page 3 - Volatility rolling min and max

Page 4 - Volatility rolling mean, standard deviation and zscore

Page 5 - Volatility distribution

Page 6 - Volatility, benchmark volatility and ratio###

Page 7 - Volatility rolling correlation with benchmark

Page 3 - Volatility OLS results

Example usage:

import volest

import data

# data

symbol = 'JPM'

bench = '^GSPC'

data_file_path = '../JPM.csv'

bench_file_path = '../BENCH.csv'

estimator = 'GarmanKlass'

# estimator windows

window = 30

windows = [30, 60, 90, 120]

quantiles = [0.25, 0.75]

bins = 100

normed = True

# use the yahoo helper to correctly format data from finance.yahoo.com

jpm_price_data = data.yahoo_helper(symbol, data_file_path)

spx_price_data = data.yahoo_helper(bench, bench_file_path)

# initialize class

vol = volest.VolatilityEstimator(

price_data=jpm_price_data,

estimator=estimator,

bench_data=spx_price_data

)

# call plt.show() on any of the below...

_, plt = vol.cones(windows=windows, quantiles=quantiles)

_, plt = vol.rolling_quantiles(window=window, quantiles=quantiles)

_, plt = vol.rolling_extremes(window=window)

_, plt = vol.rolling_descriptives(window=window)

_, plt = vol.histogram(window=window, bins=bins, normed=normed)

_, plt = vol.benchmark_compare(window=window)

_, plt = vol.benchmark_correlation(window=window)

# ... or create a pdf term sheet with all metrics in term-sheets/

vol.term_sheet(

window,

windows,

quantiles,

bins,

normed

)

Hit me on twitter with comments, questions, issues @jasonstrimpel

Note that the project description data, including the texts, logos, images, and/or trademarks,

for each open source project belongs to its rightful owner.

If you wish to add or remove any projects, please contact us at [email protected].