refraction-ray / Xalpha

Programming Languages

Projects that are alternatives of or similar to Xalpha

xalpha

基金投资的全流程管理

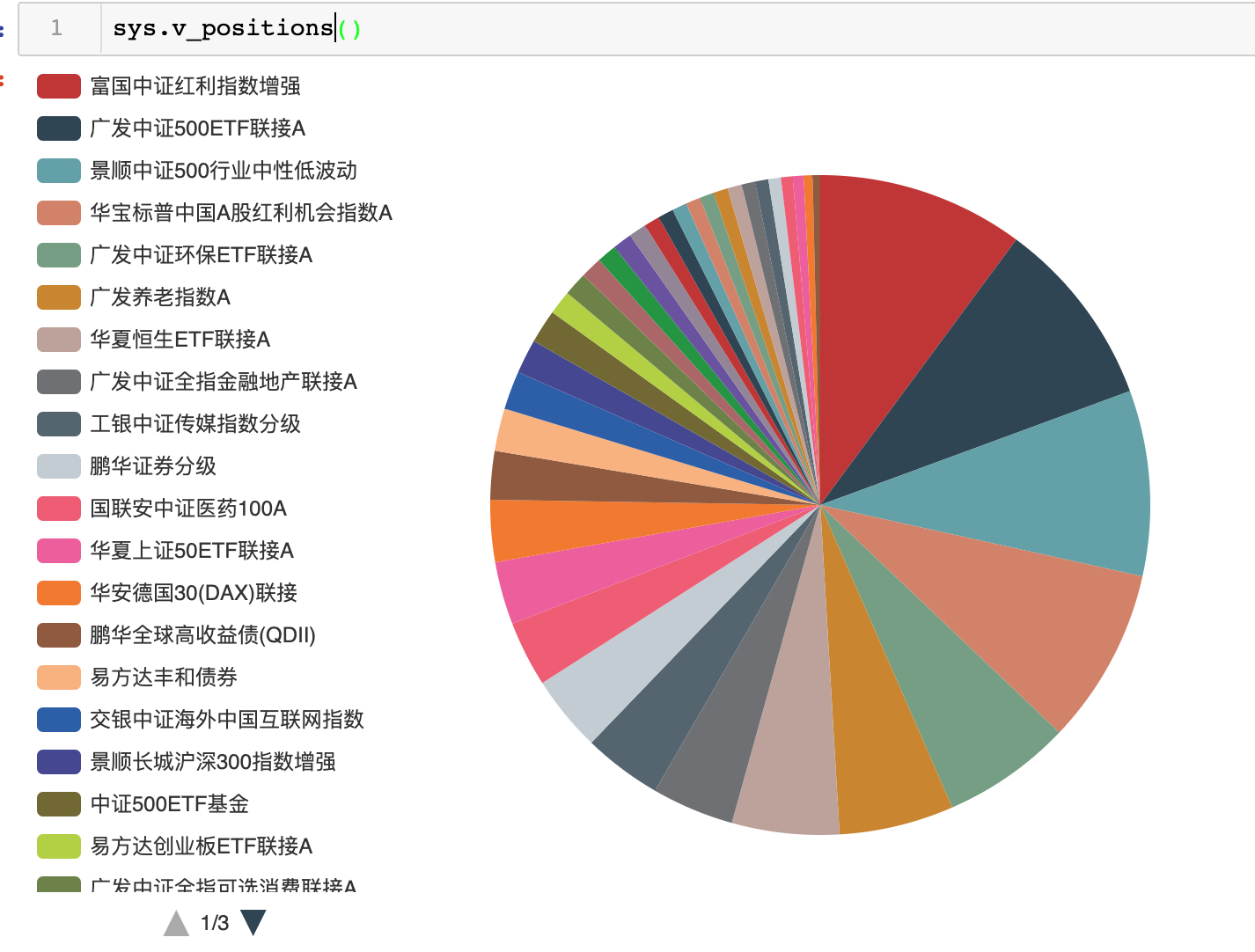

场外基金的信息与净值获取,精确到分的投资账户记录整合分析与丰富可视化,简单的策略回测以及根据预设策略的定时投资提醒。尤其适合资金反复进出的定投型和网格型投资的概览与管理分析。

🎉 0.3 版本起支持通用日线和实时数据获取器,统一接口一行可以获得几乎任何市场上存在产品的价格数据,进行分析。

🍭 0.9 版本起支持持仓基金组合的底层持仓配置和股票细节透视,掌握底层持仓和跟踪机构股票池与买卖特点,从未如此简单。

一行拿到基金信息:

nfyy = xa.fundinfo("501018")

一行根据账单进行基金组合全模拟,和实盘完全相符:

jiaoyidan = xa.record(path) # 额外一行先读入 path 处的 csv 账单

shipan = xa.mul(status=jiaoyidan) # Let's rock

shipan.summary() # 看所有基金总结效果

shipan.get_stock_holdings() # 查看底层等效股票持仓

一行获取各种金融产品的历史日线数据或实时数据

xa.get_daily("SH518880") # 沪深市场历史数据

xa.get_daily("USD/CNY") # 人民币中间价历史数据

xa.get_rt("commodities/crude-oil") # 原油期货实时数据

xa.get_rt("HK00700", double_check=True) # 双重验证高稳定性支持的实时数据

一行拿到指数,行业,基金和个股的历史估值和即时估值分析(指数部分需要聚宽数据,本地试用申请或直接在聚宽云平台运行)

xa.PEBHistory("SH000990").summary()

xa.PEBHistory("F100032").v()

一行定价可转债

xa.CBCalculator("SH113577").analyse()

一行估算基金净值 (QDII 基金需自己提供持仓字典)

xa.QDIIPredict("SH501018", positions=True).get_t0_rate()

xalpha 不止如此,更多特性,欢迎探索。不只是数据,更是工具!

文档

在线文档地址: https://xalpha.readthedocs.io/

或者通过以下命令,在本地doc/build/html内阅读文档。

$ cd doc

$ make html

安装

pip install xalpha

目前仅支持 python 3 。

若想要尝试最新版,

$ git clone https://github.com/refraction-ray/xalpha.git

$ cd xalpha && python3 setup.py install

用法

本地使用

由于丰富的可视化支持,建议配合 Jupyter Notebook 使用。可以参照这里给出的示例连接,快速掌握大部分功能。

部分效果如下:

在量化平台使用

这里以聚宽为例,打开聚宽研究环境的 jupyter notebook,运行以下命令:

>>> !pip3 install xalpha --user

>>> import sys

>>> sys.path.insert(0, "/home/jquser/.local/lib/python3.6/site-packages")

>>> import xalpha as xa

即可在量化云平台正常使用 xalpha,并和云平台提供数据无缝结合。

如果想在云平台研究环境尝试最新开发版 xalpha,所需配置如下。

>>> !git clone https://github.com/refraction-ray/xalpha.git

>>> !cd xalpha && python3 setup.py develop --user

>>> import sys

>>> sys.path.insert(0, "/home/jquser/.local/lib/python3.6/site-packages")

>>> import xalpha as xa

由于 xalpha 整合了部分聚宽数据源的 API,在云端直接 xa.provider.set_jq_data(debug=True) 即可激活聚宽数据源。

致谢

感谢集思录对本项目的支持和赞助,可以在这里查看基于 xalpha 引擎构建的 QDII 基金净值预测。